Max 403b Contribution 2025 Catch Up

Max 403b Contribution 2025 Catch Up. It will go up by $500 to $23,000 in 2025. The maximum 403(b) contribution for 2025 is $23,000.

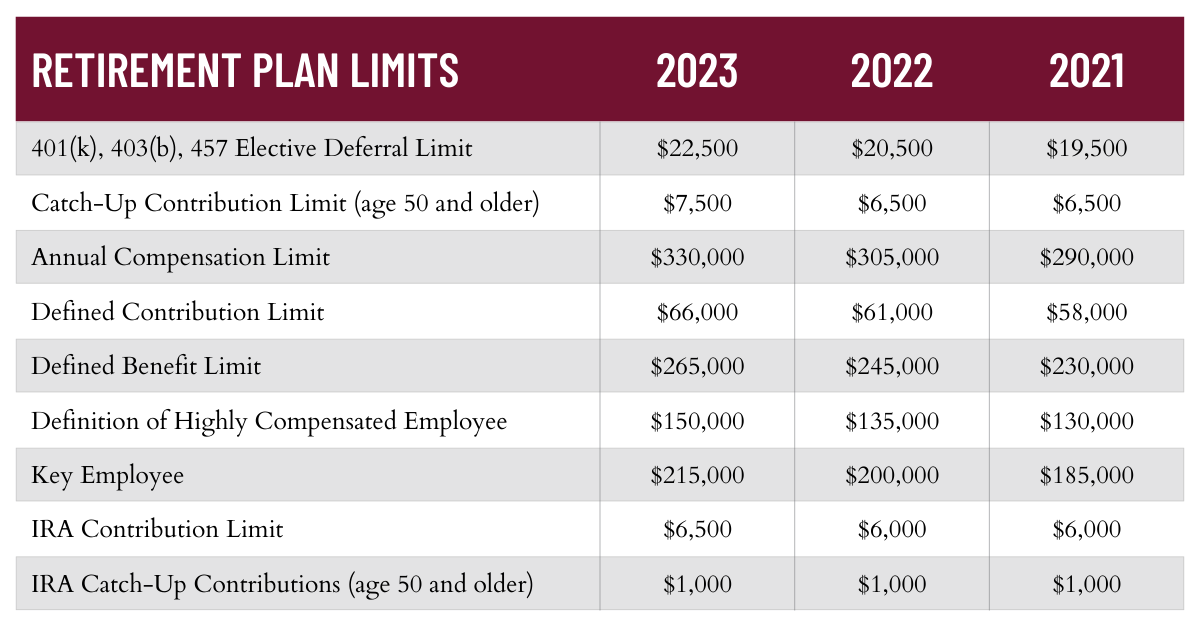

If you exceed this contribution limit, the irs will tax your funds twice. Irs 401k catch up contribution limits 2025.

The maximum amount an employee can contribute to a 403 (b) retirement plan for 2025 is $23,000, up $500 from 2025.

Max 403b Contribution 2025 Catch Up Cecily Tiphani, The maximum 403(b) contribution for 2025 is $23,000. Workers who contribute to a 401 (k), 403 (b), most 457 plans and the federal government’s thrift.

Maximum 403b Contribution 2025 Raine Carolina, This contribution limit increases to $23,000 in 2025. If you exceed this contribution limit, the irs will tax your funds twice.

What is a 403b catchup contribution? YouTube, If permitted by the 403 (b) plan, employees who are age 50 or over at the end of the calendar year can also make catch. The annual 403 (b) contribution limit for 2025 has changed from 2025.

2025 Irs 403b Contribution Limits Catlee Alvinia, This is the total amount that you can contribute to your 403(b) plan from your salary before taxes. Workers who contribute to a 401 (k), 403 (b), most 457 plans and the federal government's thrift savings plan can contribute up.

Maximize Your 403b Mastering CatchUp Contributions!, This contribution limit increases to $23,000 in 2025. If you exceed this contribution limit, the irs will tax your funds twice.

2025 Irs 403b Contribution Limits Catlee Alvinia, This calculator is meant to help you determine the maximum elective salary deferral contribution you may make to your 403(b) plan for 2025. 2025 max 401k contribution limits catch up.

Max 403b Contribution 2025 Catch Up 2025 Alayne Anatola, For help using the calculator,. The annual 403 (b) contribution limit for 2025 has changed from 2025.

403b Max Contribution 2025 With Catch Up Gerry Juditha, This is the total amount that you can contribute to your 403(b) plan from your salary before taxes. It will go up by $500 to $23,000 in 2025.

403 B Contribution Limits 2025 Faunie Maurita, This calculator is meant to help you determine the maximum elective salary deferral contribution you may make to your 403(b) plan for 2025. 2025 max 401k contribution limits catch up.

Max 403b Contribution 2025 Jeanne Maudie, The 2025 403 (b) contribution limit is $23,000 for pretax. Those 50 and older can contribute an additional $7,500.